Are you looking for a new home? Then you will probably be grappling with the question of all questions: Should I buy or rent the property? In most cases, however, there is no clear answer to this question. Both buying and renting have advantages and disadvantages that need to be compared and weighed up. This is the only way to make the best decision for you.

Why should you buy a property?

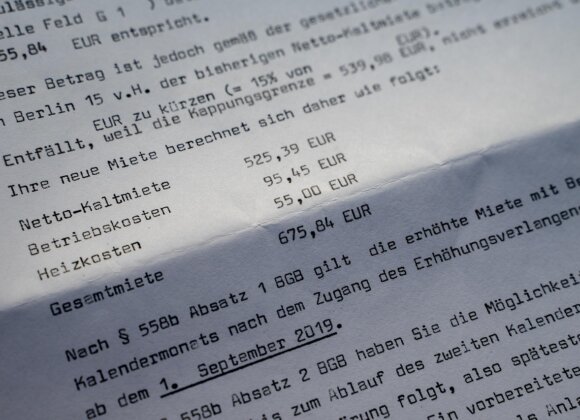

One of the main advantages of owning apartments and houses is the fact that you are immune to rent increases. Especially in times of rising rents, buying your own property can therefore be a guarantee of affordable living space in the long term. Another point in favor of buying a property is the significantly greater freedom of choice and design. If you are the owner, you can remodel and redesign your apartment and house as you wish – subject to the relevant building regulations, of course. If you are renting, on the other hand, you must always obtain the owner’s consent for major measures, which the owner can refuse.

What are the disadvantages?

Only in the rarest of cases can the property be paid for out of petty cash. In most cases, the purchase is financed with a loan. This means that monthly loan installments are due for an average of ten to 20 years. Like the rent, these are also paid from current income.

However, if you have opted for a fixed interest rate for a loan, you are protected from unpleasant surprises, i.e. unexpected interest rate increases, unlike with renting. Buy-to-rent calculators, which can be found online, provide an initial guide to the costs of renting or buying a property.

Potential buyers should also be aware that the purchase of a property will tie up capital. This can become a problem if finances become tight.

And there’s something else you shouldn’t forget: As an owner, you also have to pay for repairs, renovations and improvements. To ensure that a new roof and other measures do not put a strain on the budget, owners should therefore build up appropriate reserves. But there is another reason why it is important to keep your property in good condition:

The value of an apartment or house is determined by factors such as location, area and the size and configuration of the plot, as well as the age and condition of the property. Anyone buying a property should therefore not automatically assume that it will be worth more after a few years than at the time of purchase.

When is it worth buying a property?

On the one hand, the personal life situation plays a role: if the professional, financial and private situation is stable and the decision has been made to stay in one place for the long term, then buying a property makes perfect sense. From a financial point of view, buying a property is worthwhile if at least 20 percent equity has been saved and interest rates are low.

Does buying a property serve as a retirement provision?

This question cannot be answered in the affirmative or negative across the board either. The basic rule is: if the property is paid off at the time of retirement, more money remains in your wallet. So the earlier a property is bought, the better.

However, one thing should be borne in mind in this context: just like the owners, the properties are getting older, which means the need for renovation is increasing. This means that the better the property is maintained, the lower the loss in value. In addition, tenants can also build up assets if they have the right income or make clever investments.

For whom is renting better?

If you have little or no equity or a low income, it is better to remain a tenant, at least for the time being. This also applies if you have not yet found your dream job and/or dream partner. As a tenant, you are much more flexible when it comes to giving up your apartment or house – all you have to do is terminate the tenancy agreement and move out. Because you have to be aware of one thing: Not only does buying a property entail costs, but also selling it.

You can find properties to buy or rent here.

Related posts:

House building project – what you should know incl. checklist