At the beginning of March, the National Council once again passed a rent brake for the regulated housing market. We have summarized all the important information on the 2025 rent change for you.

In view of the high demand for rental apartments, rents have continued to rise in recent years. According to Statistics Austria, main rents including operating costs rose by 4.5 percent in 2024, compared to 7.4 percent in the previous year. Tenants would have had to dig deeper into their pockets again this year – from April, benchmark rents would have risen by three percent and category rents by 4.2 percent. With the However, the new government has once again put the brakes on rents in the “Fourth Inflation Reduction Act under Tenancy Law”.

Which apartments/rentals are affected by the rent change?

“The rent freeze affects guide value and category rents in old buildings, in council apartments and certain costs in cooperative apartments,” says AK housing law expert Clemens Berger. Furthermore, administrative costs based on category A rents have been indirectly frozen in the entire Tenancy Act (including for subsidized new buildings). Anyone renting out an apartment that is not fully covered by the Tenancy Act or the Non-Profit Housing Act, as is the case with detached and semi-detached houses, for example, is still free to adjust the rent as agreed in the tenancy agreement.

Change in rent: What exactly does this mean?

The maximum permissible category rents have been frozen for 2025. This also applies to the guideline values as a starting point for the maximum permissible guideline rent. For 2026, the Tenancy Act once again provides for an increase in line with the consumer price index. This is currently limited to 5 percent, but is to be limited to a maximum of one percent according to the government program. For 2027, the federal government plans to limit it to two percent.

If the new government has its way, from 2028 all rents, including privately financed new builds, will be capped by only passing on inflation in full up to three percent. If inflation is higher than three percent, tenants and landlords will be required to share the excess. In the event of inflation of four percent, the rent would therefore rise by 3.5 percent in this case (with 4% inflation, the rent would rise by 3.5%).

For cooperative apartments, the basic rent, the re-letting fee and the maintenance and improvement contribution (EVB) may not be increased in 2025. Financed cooperative apartments will therefore not become more expensive this year. “However, operating costs may well increase,” says Berger. For 2026 and 2027, a limit on increases of one and two percent respectively is also planned for these rents. The government’s plan is a 0,1,2,3 system. So this year 0, then 1, then 2 percent.

When can the rent actually be increased – and by how much?

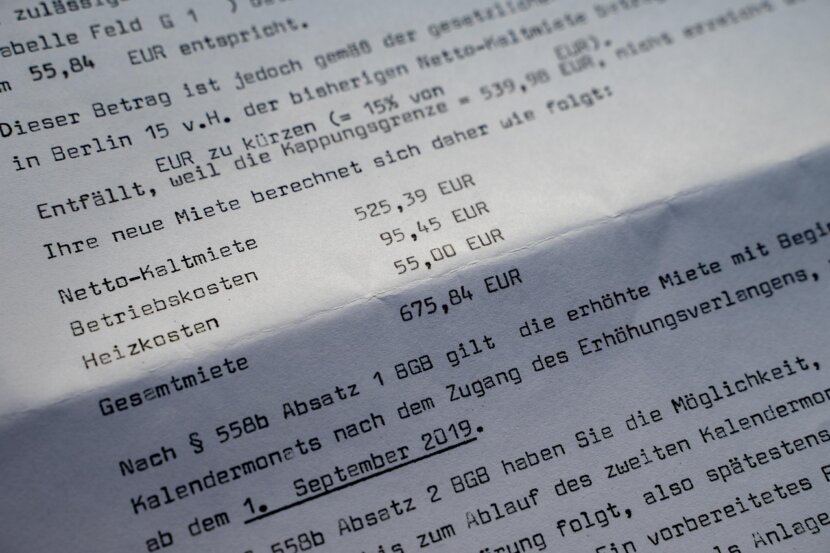

In order for the landlord to be allowed to implement a rent increase, the rental agreement must contain a value adjustment clause. In the case of benchmark rents, these clauses regularly stipulate that the rent will change in line with the benchmark values. In the past, these have changed every two years in line with inflation – unless, as is currently the case, there is a rent cap. In the last legislative period, however, this system was changed to an annual adjustment. If a rental agreement does not contain a value adjustment clause, the landlord is generally not allowed to increase the rent unilaterally.

However, there are two exceptions to this: If necessary maintenance work is required on the building for which the rent reserves are insufficient, the landlord can apply to the district court or the arbitration board for a temporary increase in the rent. And for certain very old rental agreements with a low rent (“peace rent”), the law allows a unilateral increase in the rent to a category-dependent maximum value per square meter.

What about rent increases in cooperatives?

Due to their legal form, cooperatives are only allowed to make limited profits. Their rents are therefore usually subject to the cost recovery principle. This means that the financing contributions to be paid by the tenant at the start of the tenancy (contribution to construction costs and basic costs) and the monthly rent may not generally be higher or lower than the production costs (basic, construction and ancillary costs), the ongoing property management costs, the maintenance and improvement contribution and the contributions to the reserve. However, if these costs, such as the annuities, change, this has an impact on the fee to be paid – whereby these fluctuations are possible in both directions.

However, the maintenance and improvement contribution (EVB) can also change. A statutory maximum value is defined for the EVB, which relates to the individual square meter of usable space. This maximum value increases with the age of the building. However, there are also some exceptions to the cost recovery principle – for example for business premises and fully financed apartments.

Related posts:

Planning and renting out a granny apartment